Irs macrs depreciation calculator

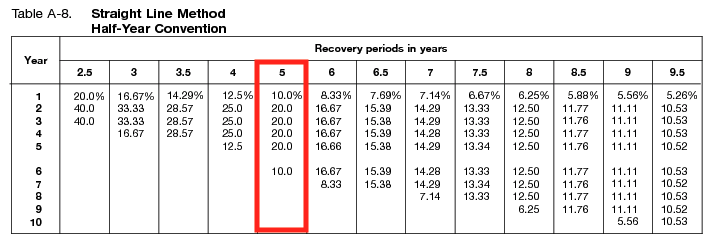

Part 2 discusses how to calculate the MACRS depreciation Rate using Excel formulas. Using the MACRS Tables.

Macrs Depreciation Definition Calculation Top 4 Methods

MACRS Depreciation Calculator Help.

. Depreciation is a loss in the value of property over the time the property is being used. Personal property includes machinery furniture and equipment. You bought a 40000 Toyota for business use and want to claim a tax deduction on this asset.

Under the half-year convention a half-year of depreciation is allowed in the first year of depreciation. Publication 534 - Introductory Material Introduction Depreciation defined. Calculate Property Depreciation With Property Depreciation Calculator.

MACRS ACRS 150 200 Declining Balance Straight-Line Sum-of-the-Years-Digits Vehicles Amortization Units of Production and Non-Depreciating asset methods are all available. The most commonly used modified accelerated cost recovery system MACRS for calculating depreciation. A general depreciation system uses the declining-balance.

The depreciation formula is pretty basic but finding the correct depreciation rate d j is the difficult part because it depends on a number of factors governed. Half-year convention In most cases the half-year convention is used for personal property. In addition it can measure the total number of clicks over a preset period of time.

Is Depreciation Tax Deductible. If you have a question about the calculator and what it does or does not support feel free to ask it in the comment section on this page. MACRS consists of two systems.

Part 3 provides a Depreciation Calculator that can be used to analyze. General Depreciation System - GDS. This information includes the.

Our property depreciation calculator helps to calculate depreciation of residential rental or nonresidential real property. The MACRS depreciation calculator adheres to US income tax code as found in IRS Publication 946 opens in new tab. This can be used as a MACRS depreciation calculator.

Yes depreciation is an income tax deduction. You consult the IRS MACRS Depreciation Tables. This page is the first of a 3-part series covering Depreciation in Excel.

Under MACRS these three conventions determine when property is placed in service. Assets are depreciated for their entire life allowing printing of past current and. The first chart the MACRS Depreciation Methods Table tells you your Toyota is a non-farm 3- 5- 7- and 10-year property and that you use the GDS 200 method to calculate how much tax to deduct.

Under this system depreciation can be calculated using the declining balance method or the straight line method. Above is the best source of help for the tax code. It also discusses other information you need to know before you can figure depreciation under MACRS.

Tables A-1 through A-5 in IRS publication 946 outline depreciation rates that depend. Rather the IRS allows you to deduct only a portion of the cost each year over the number of years the asset is expected to last. For example if you purchase a computer for 1500 you generally cant.

IQ Calculators hopes you found this. Star Software Fixed Asset Depreciation provides for Book Tax Alternate ACE and Other State depreciation. Part 1 provides a Depreciation Schedule for financial reporting and explains the formulas used for the basic common depreciation methods.

If you choose to write off the cost of depreciation each year youll use the modified Accelerated Cost Recovery System MACRS to deduct costs. In addition there are IRS tax forms and also tools for you to use such as the free Section 179 Deduction Calculator currently updated for the 2022 tax year. D j d j C.

SIGN YOUR APPROVAL FOR SECTION 179 Your voice matters. Section179Org successfully petitioned Congress to raise the Section 179 limit and with your support well ensure it remains strong. This section explains how to determine which MACRS depreciation system applies to your property.

Enter an assets cost and life and our free MACRS depreciation calculator will provide the expense for each year of the assets life. Most business and investment property placed in service after 1986 is depreciated using MACRS. Assets are grouped into property classes based on recovery periods of 3-year property 5-year property 7-year property 10-year property 15-year property 20-year property 25-year property 275-year residential rental property.

This CPS calculator has been developed to count the number of clicks a user makes in one second. This calculator performs calculation of depreciation according to the IRS Internal Revenue Service that related to 4562 lines 19 and 20. The general depreciation system GDS and the alternative depreciation system ADS.

Under the MACRS the depreciation for a specific year j D j can be calculated using the following formula where C is the depreciation basis cost and d j is the depreciation rate. This is the current tax depreciation rules in the USA.

Modified Accelerated Cost Recovery System Macrs A Guide

Macrs Depreciation Calculator With Formula Nerd Counter

Macrs Depreciation Calculator Straight Line Double Declining

Free Modified Accelerated Cost Recovery System Macrs Depreciation

Macrs Depreciation Calculator Irs Publication 946

Macrs Depreciation Calculator Irs Publication 946

The Mathematics Of Macrs Depreciation

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

How To Calculate Macrs Depreciation When Why

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

Free Macrs Depreciation Calculator For Excel

Guide To The Macrs Depreciation Method Chamber Of Commerce

Calculating Macrs Depreciation F9 Finance

Macrs Depreciation Definition Calculation Top 4 Methods

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator Based On Irs Publication 946